- cross-posted to:

- technology

- cross-posted to:

- technology

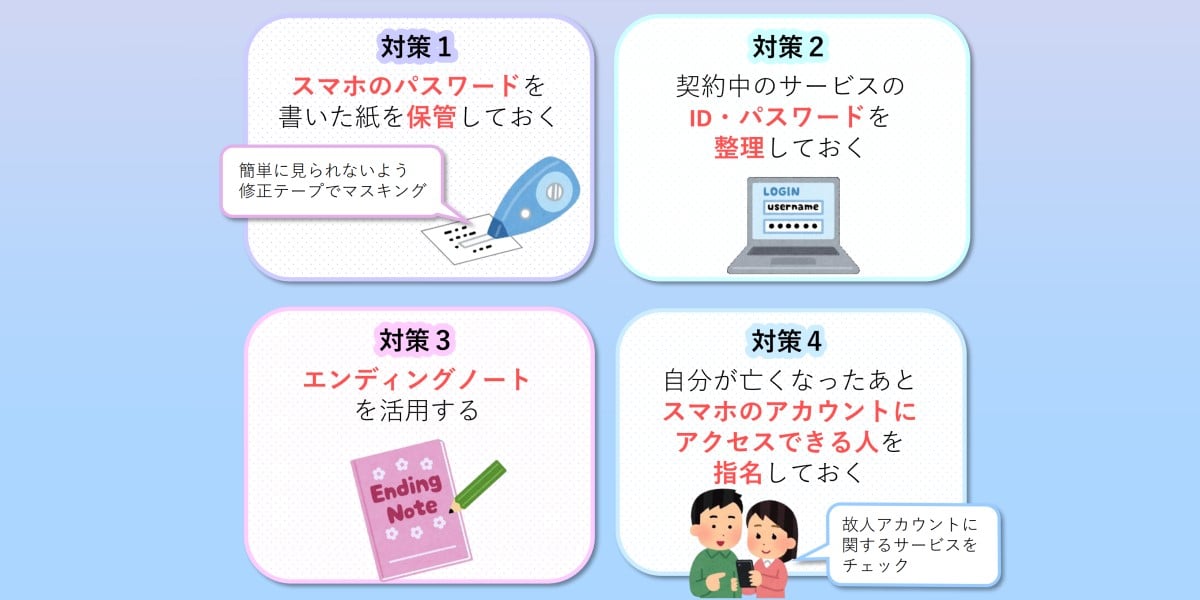

Japan’s National Consumer Affairs Center on Wednesday suggested citizens start “digital end of life planning” and offered tips on how to do it. The Center’s somewhat maudlin advice is motivated by recent incidents in which citizens struggled to cancel subscriptions their loved ones signed up for before their demise, because they didn’t know their usernames or passwords. The resulting “digital legacy” can be unpleasant to resolve, the agency warns, so suggested four steps to simplify ensure our digital legacies aren’t complicated:

- Ensuring family members can unlock your smartphone or computer in case of emergency;

- Maintain a list of your subscriptions, user IDs and passwords;

- Consider putting those details in a document intended to be made available when your life ends;

- Use a service that allows you to designate someone to have access to your smartphone and other accounts once your time on Earth ends.

The Center suggests now is the time for it to make this suggestion because it is aware of struggles to discover and resolve ongoing expenses after death. With smartphones ubiquitous, the org fears more people will find themselves unable to resolve their loved ones’ digital affairs – and powerless to stop their credit cards being charged for services the departed cannot consume.

This is a symptom of the absolutely insane way digital payments work.

You give a company your card details and they’re able to charge whatever they want, whenever they want, by default. That’s like paying at a restaurant by handing the waiter your entire wallet and telling them to take out the cost of the meal.

That’s like paying at a restaurant by handing the waiter your entire wallet and telling them to take out the cost of the meal.

Isn’t that basically how it works in the US?

Yes, yes it is. The only deterrent really is the will of the employee to commit fraud and/or a customer noticing. I’ve had to handle coworkers in the past writing in tips on blank tip lines on the reciepts that the customer signed.

Password manager with a delegated access structure is the way to go. If my sister (who I have delegated to) requests access, provides a death certificate,and waits some cool-off period, she gets access to the portions of my password vault I designate. I will grant her access to my financials upon death, but not social media and private stuff.

Versus writing it down and giving it to a lawyer who probably has the same opsec as their 1920s counterpart.

Also are you going to update if every three months when you change your passwords? Writing it down gives only a false sense of legacy access that will likely never end up working

Eh The things that actually matter, like phone, banks and utilities, and just about everything else, only require you tell them of the death. They might want proof such as a death certificate, but that’s normal.